The income tax filing process in Malaysia. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with.

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

. Assessment Year 2018-2019 Chargeable Income. Headquarters of Inland Revenue Board Of Malaysia. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any.

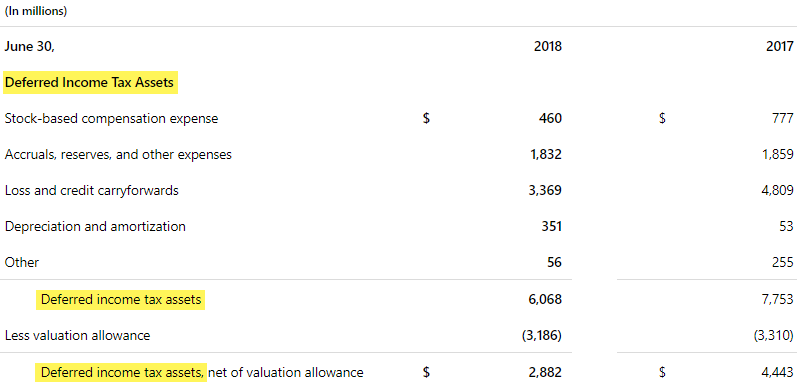

Here are the income tax rates for non-residents in Malaysia. On the First 5000 Next 15000. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope.

20182019 Malaysian Tax Booklet. The system is thus based on the taxpayers ability to pay. He or she has been resident in Malaysia for less than 182 days of the tax year but was resident in the.

The following rates are applicable to resident individual taxpayers for YA 2021 and 2022. He or she has been resident in Malaysia for 182 days of the tax year. Income attributable to a Labuan business.

Personal income tax rates. Malaysia Personal Income Tax Rate was 30 in 2022. Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share capital of MYR 25 million and below at the beginning of the basis period for a year of assessment.

On the First 5000. Corporate Income Tax. A non-resident individual is taxed at a flat rate of 30 on total taxable income.

For single filers it. Corporate tax rates for companies resident in Malaysia is 24. On the First 5000.

Commissioner for Revenue Inland Revenue Personal Tax Tax Rates 2018. TAX RATES Chargeable Income. Calculations RM Rate TaxRM 0 - 5000.

That number will jump to 24000. Rate TaxRM A. Now that youre up to speed on whether youre eligible for taxes and how the tax rates work lets get down to the business of actually filing your taxes.

In Malaysia an individual regardless of citizenship is liable for income tax if he or she fulfils any of the following criteria. The standard deduction in 2018 as the law currently exists is 13000 for a couple filing jointly. In the calendar year 2018 the tax rate for medium sized business in Malaysia was 196 percent of commercial profits.

There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. United Arab Emirates 1605 GDP. Malaysia Personal Income Tax Guide.

Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Tax Rate of Company. Tax Rates for Basis Year 2018.

This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. 20182019 Malaysian Tax Booklet Personal Income Tax. Such as sales or value added tax or personal income tax but not paid by.

Year Assessment 2017 - 2018. The deadline for filing income tax in Malaysia is April 30 2019 for manual. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor.

2018 2019 Malaysian Tax Booklet

Income Tax Malaysia 2018 Mypf My

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

U S Estate Tax For Canadians Manulife Investment Management

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Why It Matters In Paying Taxes Doing Business World Bank Group

Deferred Tax Asset Journal Entry How To Recognize

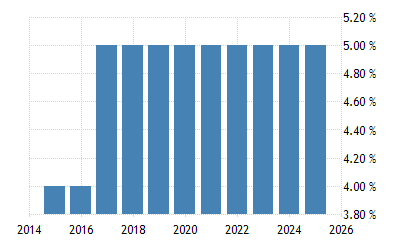

Eritrea Sales Tax Rate Vat 2022 Data 2023 Forecast 2014 2021 Historical

Income Tax Malaysia 2018 Mypf My

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

How Train Affects Tax Computation When Processing Payroll Philippines

Income Tax Malaysia 2018 Mypf My

Income Tax Malaysia 2018 Mypf My

Which States Made The Most Tax Revenue From Marijuana In 2018 Infographic

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Save Thousands Of Dollars In Taxes With A Student Visa Go Study Australia

Income Tax Malaysia 2018 Mypf My